Excise Tax Report (JP)

Rounding

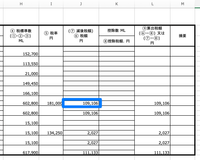

Section titled “Rounding”The 税額算出表 (Excise Tax Declaration) tab is where the litres of alcohol is multiplied by tax rates to get tax totals.

Japan favours truncating over rounding. The example screenshot below shows an example of how the Tax Totals should be calculated.

The blue box shows a total 109,106. This is calculated with the following formula:

NEW June ‘25 - round down summary row

two cells left of the blue box is 602,800. If this value was 602,805…

volume = 602,805

Round down to the nearest 10

set volume in the summary cell below = 602,800

then we multiply the tax rate by the summary cellTRUNC((602,800 / 1000) * (181,000 / 1000))

= 109,106

If you don’t truncate, the total comes to 109,106.8. Excel likes to round decimals, so it is important we truncate the subtotal.

This means the total of 111,133 does not need to be truncated, as the subtotals already have been.