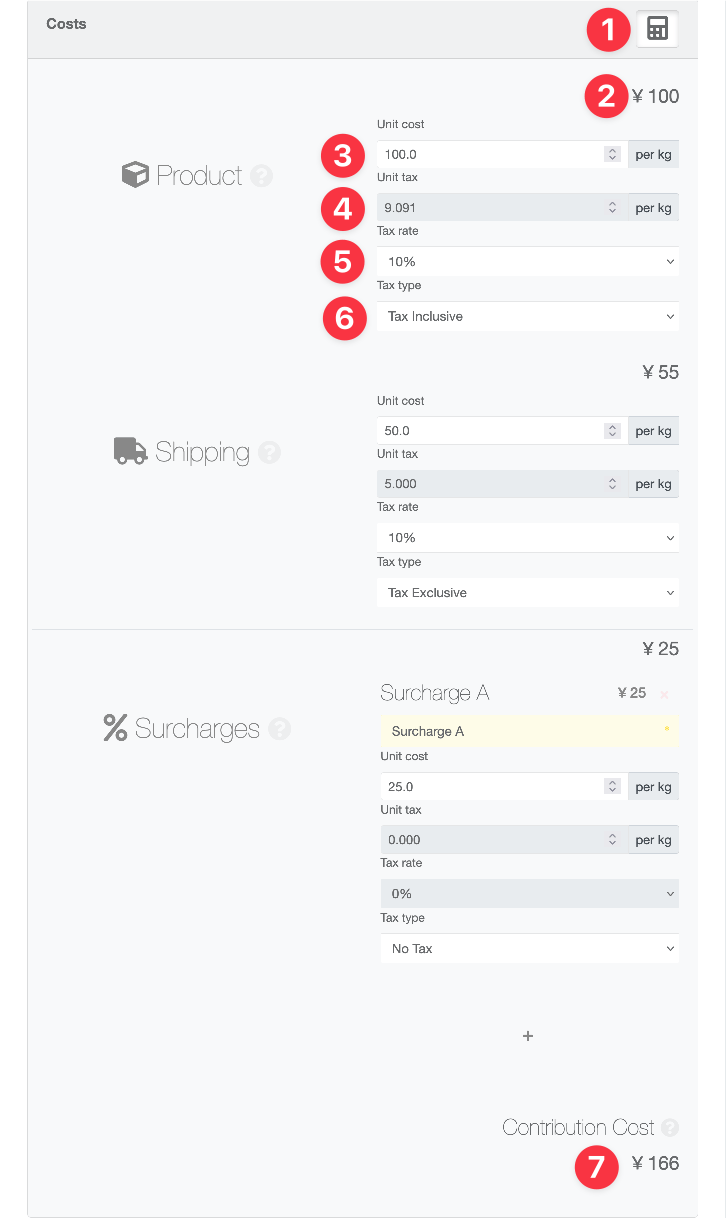

Lot Pricing

Lot pricing now has separate inputs for Product, Shipping, and each Surcharge. Each of these can have their own unit cost, tax rate, tax type (inclusive / exclusive / exempt).

- Calculator turns on / off automatic tax calculation

- Subtotal for each cost

- Unit cost input for the user

- Unit tax

Can be calculated automatically using the (1) calculator or input manually by the user - Tax rate selection (10%, 8%, 0%)

- Tax type selection (Inclusive / Exclusive / No Tax)

- Contribution Cost total

Include / Exclude Tax in Contribution Costs Settings

Section titled “Include / Exclude Tax in Contribution Costs Settings”The Contribution Cost is the total cost of a single unit of a raw material, including Shipping and Surcharges. You can choose whether or not you want taxes to be included when viewing your Contribution Cost.

Production > Settings > Brewery

- Scroll down to the Brewery Settings section

- Toggle Include tax in Contribution Cost to be on or off

- Press